|

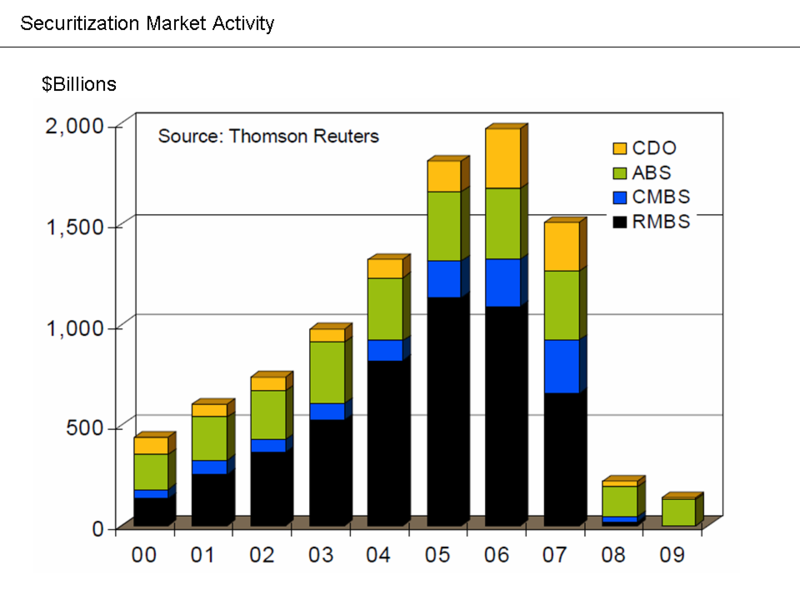

| $2 Trillion in Lost Money |

Then some people got greedy or "smart" and decided to split the CDOs based on the ability of the homeowners to pay, based on their credit score more or less. The advantage of this is that while the people are paying you are making more money on the sub-prime CDOs than the prime CDOs. Secondly, there is a little thing a called selling short, which means you borrow shares to sell then at a later date you buy those shares back and return them to the lender. In other words you make money when stock prices go down. With so many sub-prime CDOs available when the market started to go south just about anyone on Wall Street would probably have the insight to sell short on bad CDOs, even though other financial institutions. In other words, people got rich using CDOs and then by watching the market like a hawk, they stayed rich while people across the county lost their homes and retirement savings.

In short, when Warren Buffet says it's a bad investment, it probably is.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.